Oregon Legislative Recap

From Lobbyist Paul Cosgrove

Since the beginning of the pandemic emergency, the Oregon Legislature has met in three special sessions and one regular (long) session, and the Legislative Emergency Board has met an additional 13 times. All committee and Emergency Board meetings were entirely virtual. As required by the Constitution, final votes on the floor of the House and Senate were held in person in their respective chambers in the Capitol, but the Capitol was otherwise closed to everyone other than legislators and essential staff. As is true with many other endeavors, the work of legislative advocacy is best done face to face, for reasons of both effectiveness and efficiency. And that wasn’t possible this year.

Initially, the outlook for the state’s budget looked very bleak. In one of the special sessions in the summer of 2020, nearly $300 million of budget cuts were made, including 15% cuts in funding to the smaller CAC approved capital construction projects. The nearly total halt of Lottery video poker and sports betting sales due to the pandemic also resulted in cancellation of the 2020 lottery bond sale that would have funded two other CAC approved capital construction projects.

Thankfully, by the beginning of 2021, the projections for Oregon personal and corporate income tax revenues went from dramatically lower to even more dramatically higher – an unprecedented swing in the space of 6 months. And Lottery sales moved back to near normal levels. And combined with the flood of federal recovery money in early 2021, the 2021 legislative session pivoted from a budget cutting exercise to the exact opposite; how the Legislature should spend money to help individuals and organizations recover became the primary budget work of the session.

CAC started to develop its legislative priorities before the magnitude of the pandemic was evident, and while not eliminating any, we added new ones to address the pandemic’s impact on the cultural sector. There was constant conversation needed with the Governor’s office to develop appropriate guidance for member operations during the pandemic. And in June 2020, advocacy was successful in achieving a $50 million allocation by the Emergency Board of federal CARES Act funding for the non-profit and for-profit cultural sectors. By the end of the 2021 session, the largest ever slate of CAC endorsed capital construction projects (totaling $9.5 million) was approved, along with funding for the two projects affected by the cancellation of the 2020 lottery bond sale (HB 5006-Section 74, and SB 5534-Section 44). And the Main Street Program fund will be replenished with $10 million from the next lottery bond sale (SB 5534-Section 20).

The film/video payroll tax credit was modified (HB 2456-Section 14 and HB 3010), although a proposal to expand it (HB 3244) did not pass. A commitment was made by legislative leaders to address the historic property tax exemption program in the 2022 session, starting with the agency’s proposal (SB 108). The Oregon State song has new, non-racist lyrics (HCR 11), and the legislature was primed to consider a brand-new state song in the future. And finally, another $50 million (this time from Oregon’s share of the federal American Recovery Plan Act funding) was approved to help the cultural sector (broadly defined) recover and reopen (HB 5006, Section 200).

DOWNLOAD THE FULL BILL SUMMARY

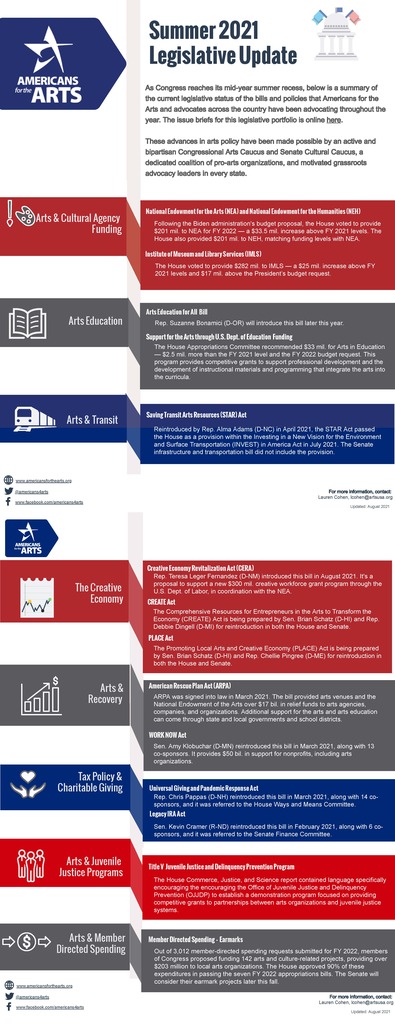

Federal Legislative Update as of August 2021

As Congress reaches its mid-year summer recess, below is a summary of the current legislative status of the bills and policies that Americans for the Arts and advocates across the country have been advocating throughout the year. The issue briefs for this legislative portfolio is online here.